On the Path to global ascendancy in e-Tailing by creating Shared Value

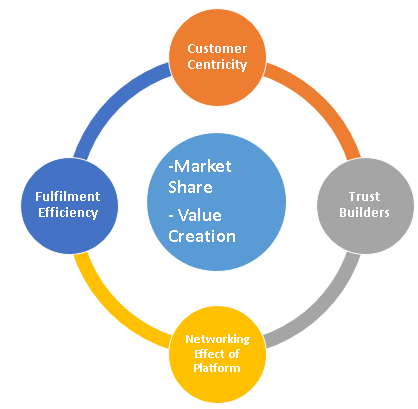

Four Strategic Pillars of Alibaba for Value Creation

Photo: Xinhua

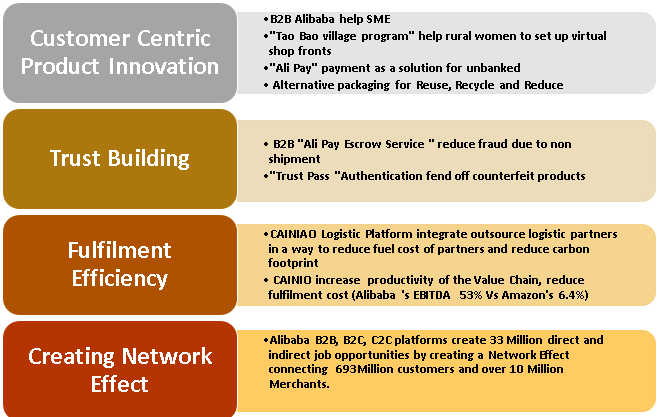

In China, Alibaba had built competencies in areas that affect customer and logistic

(Fulfilment) while focussing on improving network effect and building trust. Alibaba had demonstrated and proved that the four strategic pillars adopted by them; Customer Centric Innovation, Trust Building, Network Effect of Platforms and Fulfilment Efficiency create Shared Value while making Alibaba sustainable.

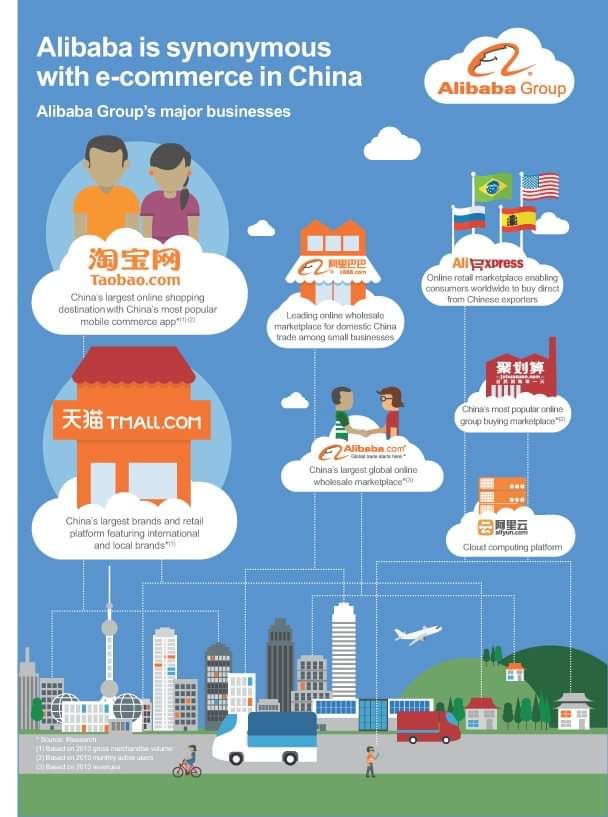

1.0 An overview of Alibaba Group

“In other countries, e commerce is a way to shop, but in China it is a lifestyle”

Jack Ma

Alibaba Group (NYSE: BABA) is a Chinese based e Commerce company providing B2B, B2C, C2C core services via internet. These services are complemented by non-core support services provided by them such as electronic payment services through Ant Financial (AliPay owned by Jack Ma), China Smart Logistic Network (CAINIAO), Cloud Services (Ali Cloud), Big Data Analytics for Marketers (AliMama). Initially it was launched as a B2B e Commerce site with the mission of helping small businesses in China and globally. Though it was a volatile time period for internet companies in US and elsewhere, China had a conducive environment to incubate an e-commerce company like Alibaba as the online and offline trading networks owned by the State are highly inefficient and discourage shoppers. China’s growing middle class had an enormous purchasing power.

“The huge numbers of Chinese moving into the middle class is enormously high.

According to research company Gavekal Dragonomics, those who have a household

income of $8100 or more will rise from 350 Million in 2012 to 800 Million by 2020”(Tse, 2015, 73)

Initially it had outperformed its main rivals Amazon and eBay in China and it had grabbed the leadership position in B2B e Commerce globally while capturing the B2C and C2C in many markets. From the inception Alibaba had been a global company as its target customer group for B2B site Alibaba.com was a wholesaler covering over 100 countries and its key seed investors came from US (Goldman Sachs, Yahoo) and Japan (Softbank). At one stage ownership referred to as “Golden Triangle” stood at Yahoo 40%, Softbank 30% and Alibaba management 30%. These investments undoubtedly raised Alibaba’s international standing, build more confidence in the market and raised its awareness in international markets in early stages.

Alibaba clearly spelled out its Mission as follows

“Our proposition is simple: We want to help small businesses grow by solving

their problems through internet technology”. Alibaba does what a large entity does best and gives this power to smaller vendors who do the rest”(Jack Ma, IPO Prospectus NYSE 2014)

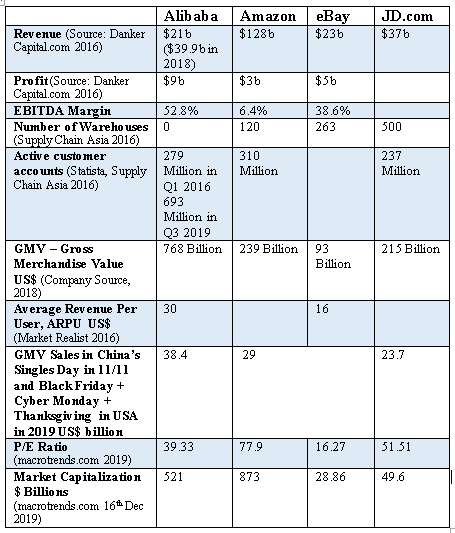

Table 1: Comparison of Key Players of e Tailing

Western media and analyst were sceptical about Alibaba’s explosive growth in the

Chinese market during 2000-2010. They attributed this growth to insularity and

immenseness of the Chinese market and protectionism of Chinese Government. They questioned its ability to penetrate international markets.

“When the Chinese companies go outside China, they will find that they

fail to understand their competitors as well as they did when they were

competing in China”(The New York Times, 23rd March 2010, Barboza)

But Alibaba challenged the above notions by conducting the world’s largest IPO in USA, becoming the largest online trading company in terms of highest Gross Merchandise Volume (GMV), penetrating their core products successfully in global markets by establishing strategic partnerships in SEA, USA and other countries within a short span of time. Traditional industries might take few decades to reach the global leadership position from relative obscurity. But Alibaba outperformed other incumbents like eBay and Amazon within a decade and created tremendous amount of shareholder value closer to half a Trillion US$, while serving the community at large.

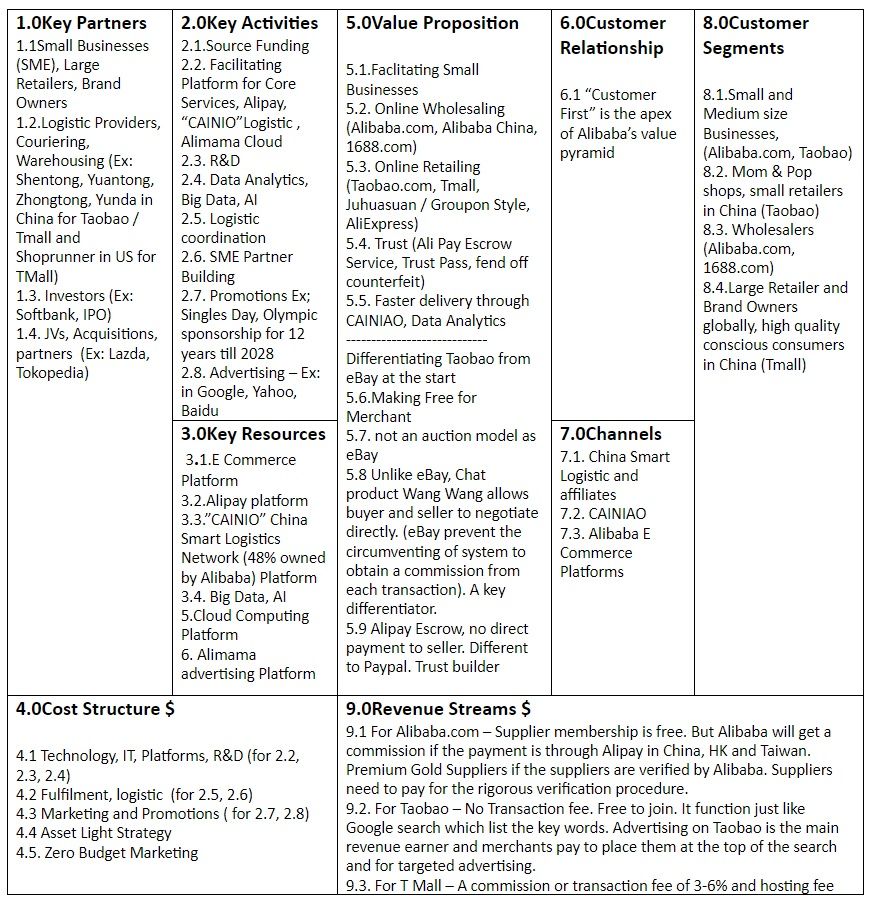

Table 2: Alibaba’s Business Model Canvas (followed Business Model Generation – Osterwalder)

2.0 Four Strategic Pillars of Alibaba for Value Creation

2.1 Asset Light Strategy and Fulfilment Efficiency created by Logistic and CAINIAO Platform backed by Big Data and AI

Wifi enabled cutting edge robots to improve efficiency of CAINIO, Logistic arm of Taobao / Alibaba Photo Credit: www.dailymail.com.uk

Order Fulfilment has an impact on Consumer Behaviour in Online Retailing. (Nguyen, Leeuw, Dullaert 2016). According to Econsultancy Multichannel Retail Survey (2013), one in two online shoppers abandon the transaction before completion due to logistic issues.

As 1.2 in Business Model Canvass (Table 2), Alibaba had outsourced physical package delivery function to 3rd parties. These 3rd parties and Alibaba had invested in China Smart Logistic or CAINIAO Platform. With a workforce of over 1.5 Million people (employed by outsource partners) handling 30 Million Packages per day, the hauling power of CAINIAO is unparalleled to any other logistic operations in anywhere. 48% of CAINIAO is owned by Alibaba and its role is mainly to develop and maintain a proprietary information platform that knit together all the logistic operators, their warehouses distribution centres and last mile delivery across the country while each operator handle their operations and business independently. CAINIAO neither owns physical Brick and Mortar infrastructure nor employs the staff handling deliveries

Alibaba’s main Chinese competitor JD.com and global competitor Amazon pursue an Asset Heavy strategy of owning logistic infrastructure like warehouses and distribution. Thomson Reuters predict CAPEX of JD.com for warehousing in 2017 is estimated at $1.4 Billion. But Alibaba leverages its strengths of Platforms, IT, Big Data (3.3 of Business Model Canvass, Table 2) to make these vital operations effective though they do not invest or own Brick and Mortar infrastructure which handles almost a 256,000 transactions per second and hauling almost 800 Million packages on Singles Day promotion (statistics of Singles Day 11th November 2017, released by Forbes.) This is a growth of 39%. It is a good testimony for the effectiveness and robustness of the Network.

“…..Alibaba’s revenue of nearly $22Billion is tiny compared with Amazon’s $136Billion. But Alibaba is far more profitable. Alibaba had operating profits of $6.7Billion in the 12 month ending 31st Dec 2017 Vs Amazon’s $4.2Billion.Whereas Amazon owns warehouses, inventory, Alibaba is an “Asset Light” technology platform, making money from Advertising and other marketing related fees.”

(Fortune, March 24 2017, Lashinsky)

Lack of control in outsourcing logistic was a genuine concern at the very beginning and Alibaba had taken steps to improve Trust Builders as discussed in section 2.3 to address these issues. They also had improved the intelligence of CAINIAO platform to create an ecosystem to match JD.com’s speed of delivery.

“Data Analytics can significantly augment the capabilities of both the platform company (Alibaba) and its ecosystem partners, making the platform more successful and greatly increasing the ability to generate value for users. Analytics can guide investment in product design and in customer and partner success, reinforcing the platforms network effects. Collectively these new data tools create a formidable barrier to entry – a platform version of Porter’s competitive moat”

(Parker, Alstyne, Choudhry, 2016, 219)

2.2 Customer 1st or Customer Centric Product Innovation

Figure 1: Core Values of Alibaba Source: Alibaba

Key differentiators against JD.com, eBay and Amazon in order to build customer centricity profess by company values

1. Wang Wang Chat Line

“Circumventing the system by parties (Buyer and seller) is a major inhibitor to commerce in an environment (like China) where people were accustomed to building a personal relationship before doing business”

(Erisman, 2015, 91)

Wang Wang Chat Line can be used by buyers and sellers to interact each other, bypassing T-Mall or Taobao. Circumventing the system to have direct contact with buyer and seller is not a possibility in Amazon or eBay as their main revenue generating source, the commissions from each transaction, will be seriously undermined through a chat line.

“One of the Key Success Factors for this tournament (battle between Alibaba and eBay in China) was the integration of real-time communications into the platform, so buyers and sellers could communicate with each other at the time of the sale, mostly via mobile. In December 2006, it was all over. Alibaba had won and eBay shut down its site.”

(McCarthy, 2015, 77-78)

2. Creating a compelling customer experience and engagement

“Transforming the customer experience is at the heart of digital transformation- For digital masters, these new technologies are not goals to attain or signals to send to investors. Instead, the technologies are tools that can be combined to get closer to customers. Digital mastery goes well beyond websites and mobile apps to truly transform the customer experience and how you steer customers effortlessly through it. Delivered properly, an engaging customer experience create value for both customers and firms”

(Westerman, Bonnet, MacAfee, 2014 29-30)

Alibaba use data driven technologies like AI, VR to create a customized virtual shopping experience for Taobao and T mall customers. It also help companies to conduct targeted marketing for brands. Features such as smart product search and targeted product recommendations, image matching (matching photo of an intended product with the products in the inventory) empower consumers in the virtual economy by enhancing customer experience.

CAINIO assures on time delivery and only less than 2% of the goods are damaged or dispatched late compared to 15% failed deliveries of other providers. This is a good example for Fulfilment Efficiency.

“There is a need for e-fulfilment warehouses to make the order turnaround time less than an hour”

(White Paper, Landmark Global, 2016, 4)

2.3 Trust Builders

“The analysis showed that customer Loyalty is strongly linked to the consumer’s Trust, which means that in order to create sustainability for an e-commerce firm as an intermediary, it is crucial to consider Trust as a vital element.”

(Choi, Mai, 2018, 15)

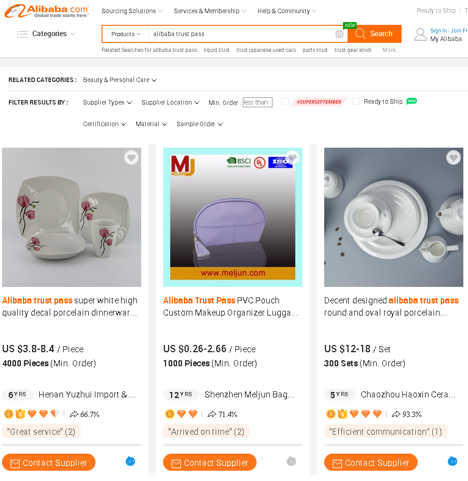

Items displayed by Alibaba Trust Pass licensed Taobao partners. Source: Alibaba

1. Process Related

a. Trust Pass – Alibaba launched a service called Truss Pass to give more confidence to the user. This is an authentication and verification process conducted by Alibaba to certify the merchant. This is a paid service and the merchants who subscribe for this appear to be more trustworthy.

b. Alibaba had deployed thousands of Client Service personnel (Xiaoer) for dispute resolution between buyer and seller

c. Retailers undergo a vetting process to get qualified to open a virtual shop on the platform.

d. Tighter control to fend off counterfeit trade and zero tolerance.

Platform Related

a. Alipay – ESCROW arrangement offered by Alipay provides a payment security for buyers and sellers. Payment is released upon the successful delivery of order, placed through Taobao, T Mall or Ali Express. Similar service is offered for Alibaba.com wholesale buyers through a system called as “Trade Assurance”. In Trade Assurance, order is placed through Alibaba and they act as custodians.

2.4 Networking Effect created between Buyers and Sellers – Economies of Scale

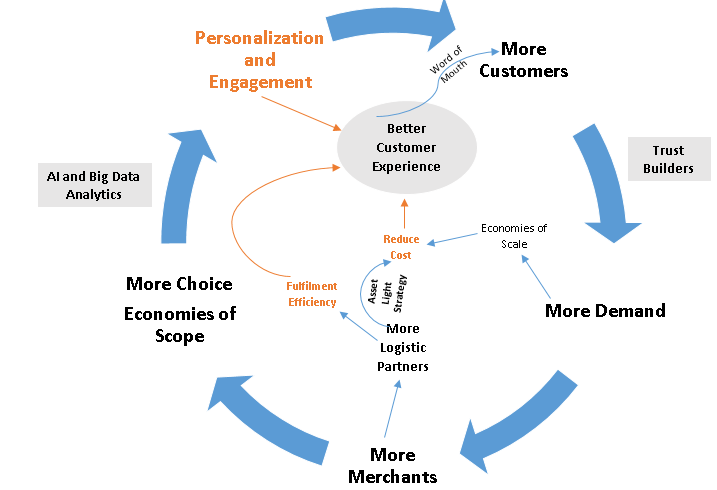

Network companies and Network Effects are created by Platforms. Alibaba is a classic example of a platform that create a two sided network effect between Buyers and Sellers (Merchants). If you add more merchants, you will have more customers. More Merchants attracts More Buyers and More Buyers attract More Merchants stimulating growth both ways.

“Network effect refer to the impact that the number of users of a platform has on the value created for each user. Positive Network effect refers to the ability of a large, well-managed platform community to produce significant value for each user of the platform”

(Parker, Alstyne, Choudary, 2016, 17)

“In the case of Uber, two sides of the market are involved: riders attract drivers, and drivers attract riders. Similar dynamic can be seen in many other platform businesses.”

(Parker, Alstyne, Choudary, 2016, 21)

“The decisive economic shift – from supply-side to demand-side economies of scale (network effect); means companies can create value by tapping into resources and capacity that they don’t have to own”

(Accenture Technology, 2016)

Figure 2: Virtuous Cycle and Network Effect of a Core e-Tailing Platform, integrated with Payment, Logistic and Analytic Platforms (for a company similar to Alibaba’s Tao Bao) Source: www.internetplusasia.com

Taobao of Alibaba created a two sided network effect and value creation in 2005 by eliminating the transaction or connection fee from merchants and buyers. This big decision, attracted virtuous cycle of merchants or sellers and buyers. When this decision was taken, eBay’s C2C market share was 90% and Taobao was insignificant. Within one year e Bay’s market share slipped to 34% when Taobao reached a level of 57%. End of 2006 eBay announced its exit from China and Taobao had become the undisputed leader in C2C and B2C markets in China.

Each organization can be classified into one of four business models. Asset Builders deliver value through the use of physical goods. (Ex: Walmart). Service Providers deliver value through skilled people (Ex: Accenture), Technology Creators deliver value through ideas (Ex; Microsoft, Oracle), Network Orchestrators deliver value through the connectivity and these companies create platform that participants use to interact or transact. (Ex:Alibaba).

“Alibaba, a Network /Platform company has a market value of $200Billion without owning a single location while Walmart, an Asset Builder maintain 11,000 locations at a market value of US$ 190Billion.)”

(Libert, Beck, Wind, 2016, 15)

2.5 Creating Shared Value by Alibaba – Analysis based on CSV model presented by Harvard Business School in 2011

According to Porter and Kramer (Harvard Business Review 2012), the process of creating Shared Value for a company is an incremental and evolved process. From the viewpoint of practicing managers Porter and Kramer’s approach is better than the Triple Bottom Line (TPL) based growth model. TPL lacks linkages to the real business and in most of the time environmental impact is not an integral part of the corporate strategy. Finding a common denominator to measure Profit (in $), Social Capital and Environment or ecological health is a daunting task consuming lot of management time.

Empowering rural women. A young village woman is selling products on-line. Photo: Xubei Luo/World Bank

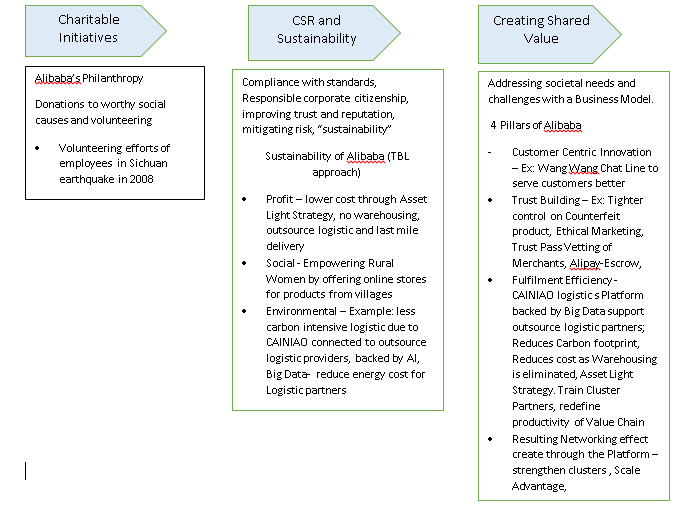

Figure 3: Evolving Approach and the role of Alibaba in Society

Figure 3: Evolving Approach and the role of Alibaba in Society

“The next transformation of business thinking lies in the principle of Shared Value; creating economic value in a way that also create value for society by addressing its needs and challenges. Shared Values incorporate corporate policies and practices that enhance the competitive advantage and profitability of the company while simultaneously advancing social and economic conditions in the communities in which it sells and operates. Shared value is not CSR, Philanthropy, or even Sustainability, but a new way to achieve economic success”

(Harvard Business School – Creating Shared Value)

As illustrated in Figure 3, Alibaba’s social development programmes go beyond Philanthropy and CSR/Sustainability by embedding CSR/Sustainable practices in the Business Model, Creating Shared Value (CSV) to benefit all the stakeholders, including the community at large. Alibaba’s Four Strategy Pillars that govern its Core and Future Businesses, Create Shared Value for Consumers, Logistic Partners, Merchants, Shareholders and Community. These four strategic pillars generate economic value in terms of profitability while producing value for society by addressing its key challenges like environmental degradation, Digital Divide, Empowerment of Women, revitalizing SME, Stimulate Banking in largely unbanked populace, employment generation, grey market etc.

Figure 4: Four Strategic Pillars of Alibaba create Shared Value- Meet Social Needs by reconceiving products, serve unserved and underserved customers, redefine productivity in the value chain and strengthening partners

List of References

– Edward Tse, China’s Disruptors (Penguin Publishing Group, 2015)

– Robin Chase, Peers Inc. (Headline Publishing Group, 2015)

– Porter Erisman, Alibaba’s World (Palgrave Macmillan, 2015)

– David Barboza, “China’s Internet giants may be stuck there”, The New York Times, March 23rd 2010, https://www.nytimes.com/2010/03/24/business/global/24internet.html

– Alexander Osterwalder, Business Model Generation (John Wiley & Sons, 2010)

– Adam Lashinsky, “How Alibaba’s Jack Ma is Building a Truly Global Retail Empire”, March 24 2017, http://fortune.com/2017/03/24/jack-ma-alibaba-china-ecommerce-world-greatest-leaders/

– Geoffrey G Parker, Marshall W. Van Alstyne, Sangeet Paul Choudary, Platform Revolution (W.W Norton & Company, 2016)

– Paul X McCarthy, Online Gravity, (Simon & Schuster Pty Ltd, 2015)

– George Westerman, Didier Bonnet, Andrew MacAfee, Leading Digital (Harvard Business Review Press, 2014)

– Barry Libert, Megan Beck, Jerry Wind, The Network Imperative (Harvard Business Review Press, 2016)

– Duncan Clark, Alibaba, The house that Jack Ma built, (Harper Collins Publishers, 2016)

– Scott Galloway, The Four, (Bantam Press, 2017)

– Helen Deresky, International Management, (Pearson, 2017)

– Jacky Wong, “Alibaba-Lazada: “A good deal that comes close to home” April 13 2016, https://www.wsj.com/articles/alibaba-lazada-a-good-deal-that-comes-close-to-home-1460461753

– Jon Russell, “Alibaba doubles down on Lazada with fresh $2B investment”, March 19th 2018, (https://www.asiaventurepedia.com/2018/03/18/alibaba-doubles-down-on-lazada-with-fresh-2b-investment-and-new-ceo/)

– Peter Elstrom, Pavel Alpeyev, Lulu Yilun Chen “Masayoshi Son: Inside the eccentric world of the controversial Japanese billionaire investor”, January 7th 2018

https://www.independent.co.uk/news/long_reads/masayoshi-son-cheng-wei-chinese-didi-chuxing-softbank-group-uber-technologies-saudi-arabia-prince-a8140561.html

– PWC Experience Centre, “The rise of China’s silicon Dragon”, June 2016

Accenture #techvision, “Platform Economy: Technology Driven business model”, 2016

– Dung H Nguyen, Sander de Leeuw, Wout E.H. Dullaert, “Consumer Behaviour and Order Fulfilment in Online Retailing: A Systematic Review” (International Journal of Management Review Vol 20, 2018) 255- 276,

– Yongrok Choi, Do Qunh Mai, “The sustainable role of e-Trust in the B2C, eCommerce of Vietnam” (Sustainability January 2018) 15

– Poh Ming Wong Winnie, “Customer Interface Quality on Customer e-Loyalty and e-Satisfaction in Malaysia with the effects of Trustworthiness”, (Global Journal of Emerging Trends in e-Business and Consumer Psychology, 2014), 118-136

– eConsultancy, Multichannel Retail Survey 2013

– Michael E Porter, Mark R Kramer, “Creating Shared Value”, (Harvard Business Review, January-February 2011) 1-17

– Landmark Global, White Paper “Outsourcing eCommerce logistic: pros and cons.”, 2016

– Alibaba Annual Report – March 2018

– Bloomberg News, “Amazon and Alibaba’s Lazada prepare to face off in South East Asia” December 15th 2016, https://www.digitalcommerce360.com/2016/12/15/amazon-and-alibabas-lazada-face-southeast-asia/

Abbreviations

AI – Artificial Intelligence

ARPU – Average Revenue per User

ASEAN – Association of South East Asian Nations

B2B – Business to Business

B2C – Business to Consumer

C2C- Consumer to Consumer

CAGR – Cumulative Average Growth Rate

CAPEX – Capital Expenditure

CSR – Corporate Social Responsibility

CSV – Creating Shared Value

EBITDA – Earnings before Interest, Tax, Depreciation and Amortization

ESCROW – a deed or bond place in custody until a specific conditions has been fulfilled

FTZ – Free Trade Zone

GMV – Gross Merchandise Value

GS – Goldman Sachs

IPO – Initial Public Offering

IT – Information Technology

JV – Joint Venture

M&A – Mergers and Acquisition

NYSE- New York Stock Exchange

P/E – Price Earnings Ratio

PEST – Political, Economic, Social & Cultural, Technological environment

R&D – Research and Development

SEA – South East Asia

SME – Small and Medium Enterprises

TPL – Triple Bottom Line

SWOT – Strength, Weakness, Opportunity, Threat

UNCTAD – United Nation Trade and Development

US-United States of America

VR – Virtual Realty

Share This

Details

Mothilal is a Co Founder of Internet Plus Asia, a co-creation platform for tech start-ups in Asia. Prior to this he was a Chief Executive Officer, Chief Strategy Officer, Chief Corporate Officer and Chief Operating Officer of number of Telecommunications and IT companies in Asia and Pacific regions for over 20 years. He is a turnaround specialist and a strategist. As CEO and C level executives, he was responsiblefor transformation and turning around many telecos. He was also instrumental in winning many international awards for these companies such as GSM awards in 3 consecutive years, International Asia Pacific Quality Award, Asia CSR award. He has obtained the Doctor of Business Administration from PPA Business School, Paris, receiving a Distinction for his DBA research, "Corporate Venture Capital as an engagement model to Co-create 5G ready services in Telco - Startup collaboration"