The Battle for supremacy in South East Asia - Lazada Vs Shopee Vs Tokopedia

Photo Credit: Creative Assembly’s Warhammer Games

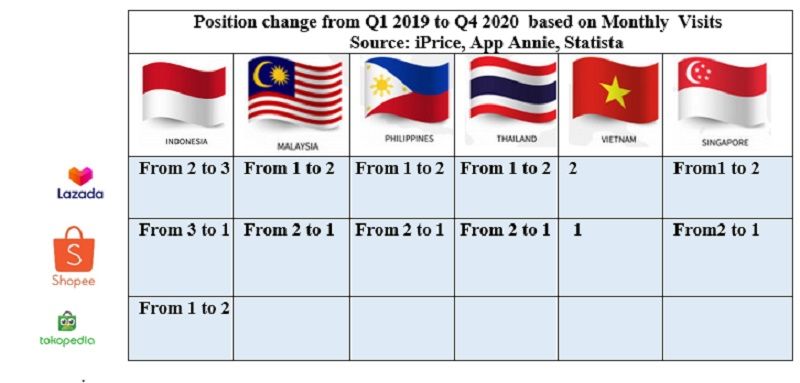

It was 1Qr 2019, I was eager to find out more details about the market position of Lazada after Alibaba’s strategic investment of US$4 billion (staggered investments from 2016 to 2018) to secure 83 % stake. As expected Lazada reigned supreme and was crowned as the leader in most of the South East Asian markets in 1Qr ’19, except Indonesia and Vietnam. Indonesia was led by Tokopedia in which Alibaba hold majority stake along with Softbank and Vietnam was led by Shopee owned by SEA Group (Games and Entertainment Unicorn based in Singapore) and Tencent, China. (owners of WeChat). In overall Shopee played a second fiddle to Lazada in 1st Qr 2019.

Surprisingly, when I screened the south east asian battle ground in mid 2020, the scenario was completely different for Lazada, compared to 1Qr 2019. Shopee, the underdog had emrged as Lazada’s formidable rival in SEA market and by the 2nd Qr 2020, Shopee had captured the leadership position in terms of Monthly Visits in almost all the coutries by overtaking Lazada. But the monthly active user figures are disputed by both companies. The competition in South East Asia is intensifying similar to Chinese market as Lazada and Shopee are both subsidiaries of two Chinese digital giants Alibaba and Tencent. Now they are engaging in an apparent digital proxy war in a different battle ground, outside China.

How can Lazada maintain it’s Market Position and prevent further market erosion in a hotly contested region? What is the winning formula for Lazada? This report try its best to analyze it based on available information. But we are happy to hear different opinions on this. This article is an opening for further discussion.

Country wise Change of Rank from 2019 to 2020 for shopping apps based on MAU (Source: App Annie, iPrice)

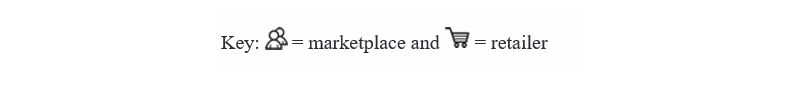

The world’s top online marketplace (Estimated monthly visits for April 2021, from Similar Web, Source: webretailer )

According to the latest research of SimilarWeb and WebRetailer, as on April 2021, Shopee is well ahead of Lazada. In terms of visit per month, Shopee holds 6th position globally while Lazada falls behind Shopee, holding 19th position. Lazada is even one position behind Tokopedia of Indonesia. Though Gross Merchandise Volume or GMV is the ideal indicator to determine the market position, GMV is not freely disclosed to outsiders. However according to a study done by Market Research agency Momentum Works, Shopee had taken the lead in Indonesia outpacing Tokopedia interms of GMV. According to them, Shopee has a marginal lead over Tokopedia with US$14.2 Billion, while Lazada lagging behind with US$ 4.5 Billion.

But According to March 2021 annual report for full financial year of Alibaba, international retail business (primarily contributed by Lazada, Ali Express and Trendyol of Turkey) over a period of one year ended in March 2021 had grown by 77%. Increasing trends in eCommerce during COVID could be the reason for this high growth.

According to the report submitted to the Securities and Exchange Commission of USA, SEA Limited, the parent company of Shopee, the YoY eCommerce revenue growth in 2020 is 116% while registering a GMV growth of 112%. This is higher than the figures registered by Lazada.

Lazada need to rethink its strategies in South East Asia.

Alibaba had gone global and its choice of Battlegrounds

Jack Ma articulated the desire to get at least 50% of its revenue from overseas operations and he had expressed his resolve to reduce the over dependence on the Chinese market as the growth in B2C market in China has a declining trend (Source: Analysis).

Why do Alibaba Select Southeast Asian (SEA) as its newest e-commerce battleground?

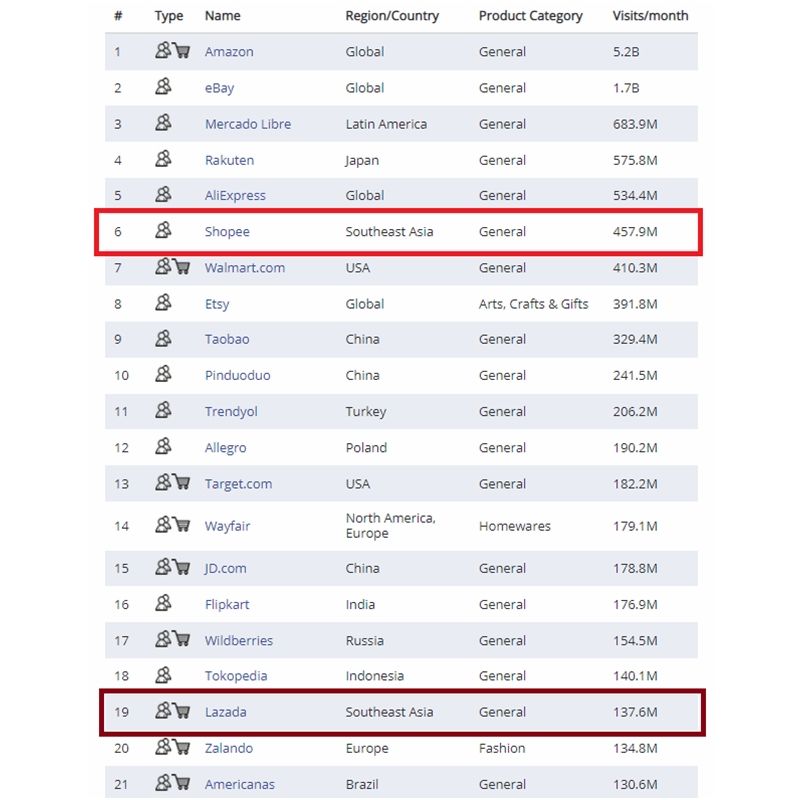

PEST for SEA in the context of e Commerce (developed by the Author)

SEA is a diverse, highly fragmented, non-homogeneous market (culturally, politically, ethnically, socially and economically) having an addressable market of 600 Million scattered over 11 countries and multiple time zones. But e-commerce market will trple in value to US$300Billion by year 2025 in this region. Two leading Chinese companies, Alibaba and Tencent had set their sights in this challenging, but lucrative market.

The crucial barrier in this market is low credit card penetration and large unbanked population. However in the post COVID situation, e-Wallet is gaining traction at the expense of Cash Payment on Delivery. There is an increase of 8 percentage points for contactless e-Wallet from 2019 to 2020. (Bain & Company, 2021). It was also not an easy task to establish their own logistic infrastructure due to geographic dispersion in places like Indonesia and Philippines. (More than 18,000 islands in Indonesia and 7000 islands in Philippines).

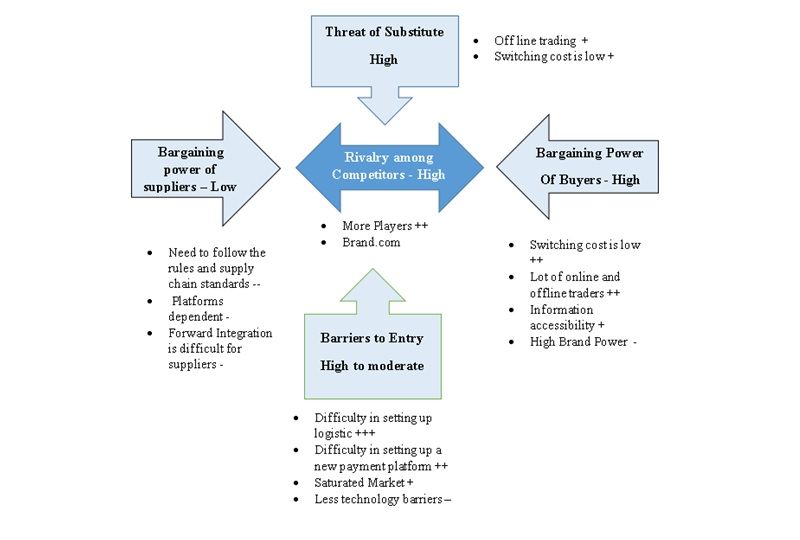

Analysis of South East Asian Market, Entry Scenario created by market rivalry

For many decades companies had used five forces model of Porter to understand which markets to enter or exit, which markets to form alliances and merges, which strategies are best to consolidate, what supply chain strategies best suit the market etc.

Barriers to Entry

As shown in above illustration, Barriers to Entry is high (or Threat of new entrants are low) mainly due to the difficulty in setting up the Payment and Logistic Platforms backed by Data Analytics. Analytics capabilities of both Lazada and Shopee are high and new Data Tools create a formidable Barrier to Entry. But from the inception Barriers to Entry were in favour of Lazada in-terms of having the 1st mover advantage and equipping data tools. Shopee’s Business Insights and analytical capabilities are of high standard currently and they empower its sellers by giving access to a performance dashboard.

Bargaining Power of Supplier and Buyer

Building an eCommerce platform and establishing logistic infrastructure are core competencies of incumbents. As suppliers need to be fully depended on an e Commerce Platform, Logistic infrastructure, last mile delivery in a scattered geography (2.3 of PEST), bargaining power of Supplier is low.

Bargaining Power of buyer is high due to the availability of large number of options in the online and offline market. In a Facebook commissioned survey, done in May 2020 in collaboration with Bain & Company, it was found that citizens of SEA switch brands often in e-Commerce, primarily due to value for money. It was also discovered that digital consumer in SEA countries shopped in 5.2 websites in pandemic hit 2020, compared to 3.8 sites in 2019. The players of e-commerce market in SEA are evenly matched in terms of product offerings and SEA market is highly fragmented.

Threat of Substitute and Rivalry among competitors

As illustrated in the above Figure, the threat of substitutes and rivalry among competitors are high due to congested market in SEA region. Small and Medium traders are realizing that piggybacking solely on Lazada or Shopee will not help them to build brand equity and customer loyalty. These small traders do not get complete access to customer data and holistic view of customer. Traders might think of establishing their own eCommerce or shift to an eCommerce site that offer better access to customer data empowering the trader to conduct special promotions on new arrivals, cross sell or up sell, offer rewards to loyalists and win back programs for churned customers.

An Overview of Lazada and Alibaba deal

Vision Compatibility and Business Synergy – Alibaba + Lazada

Lazada cover 6 countries (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam) and runs 12 warehouses, 92 distribution centres. With a populace of over 600 Million people and high growth rate for e Commerce, the region is a hot bed for online shopping. As found in PEST, Alibaba has an opportunity to capitalize the largely untapped market as the home ground is crowded.

Lazada Warehouse Photo Credit: tosot.com.ph

It has nearly 100 logistic partners and DHL Thailand, Kerry Logistic, JNE Express Indonesia are among them. After a three step investment, Alibaba reached its total investment to a level of $4Billion mark in 2018, taking complete control of Lazada. This shows the confidence placed on Lazada and SEA market by Alibaba.

“We see ourselves as a logistic control tower in South East Asia. We are looking at building a better, more sophisticated logistic capability. The world is shifting towards borderless e- Commerce system and that’s very much the vision of Alibaba and us.” – Outgoing CEO of Lazada, Dec 2016

The region is still lacking the transport and payment infrastructure, creating a huge opportunity for Alibaba to leverage its CAINIO logistic data platform and Alipay payment Platforms. Lazada is evolving from Amazon type logistic model (owning infrastructure, vertically integrated) to more like the outsourced model of Alibaba. Alibaba has lot of Business Synergy. Example: Singapore Post, in which Alibaba has a 14.5% stake, can offer some assistance in streamlining logistic.

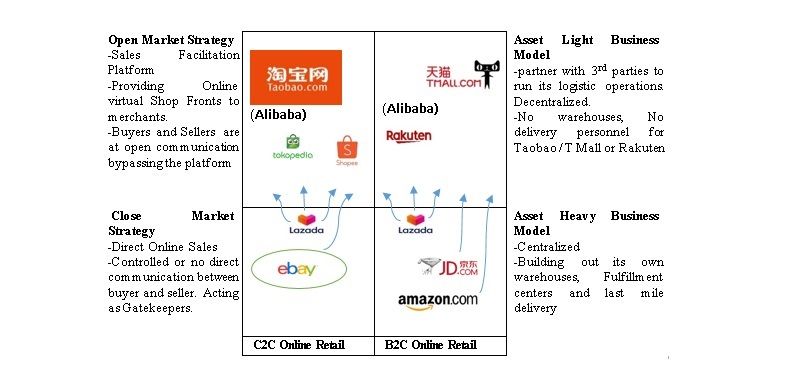

Business Model of Lazada Vs Shopee and Key Trends

Four quad representation of business models for global e-Tailing companies (developed by the author)

Lazada was partly an Asset Heavy business model and followed a close market strategy similar to JD.com of China, Alibaba’s main rival in China. Under the Open Market strategy, Lazada’s virtual marketplace facilitated the sellers to open their shop fronts in Lazada’s platform.

Lazada is progressively moving towards an Open Market Strategy or a Marketplace Platform similar to Rakuten and Taobao / TMall with the close cooperation of Alibaba. Running a Close Market Strategy in conjunction with an Open Market Strategy is a costly affair though it records a better fulfilment efficiency than Shopee. Lazada maintains its own inventory, warehouses, logistic and marketing easing the burden on seller. Lazada charge a commission from merchants on their sales for providing fulfilment service and payment. As predicted, after Alibaba’s partnership, Lazada pursued Asset Light Business Model and an Open Market Strategy more assertively.

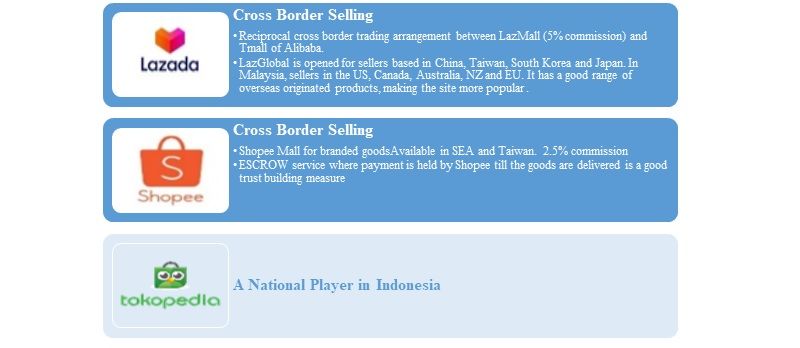

Cross Border Selling

LazMall had introduced reciprocal Cross Boarder selling in partnership with Alibaba’s Tmall Global. Now Malaysian and other SEA regional products can be sold in China and branded Chinese products can be sold in SEA countries. Malaysia is the first electronic World Trade Platform (eWTP) hub, and Alibaba’s Cainiao smart logistics will provide an end-to-end solution to efficiently move SEA regional and Malaysian products from the manufacturing facilities in SEA to cross-border e-commerce warehouses in China to reach consumers in China who make purchases on TMall interconnected with LazMall.

Synergies created by Lazada / LazMall/ Alibaba / TMall/ CAINIAO collaboration should be nurtured and strengthened to prolong the competitive edge.

Shopee staff at work Photo credit: glassdoor.com

Social Shopping / Shoppertainment

Lazada and Shopee are both strong in “Shoppertainment”. By turning Shopee platform into a Shoppertainment where the buyers can also play games or in app live streaming while engage in buying goods, it maintains a slight competitive edge.

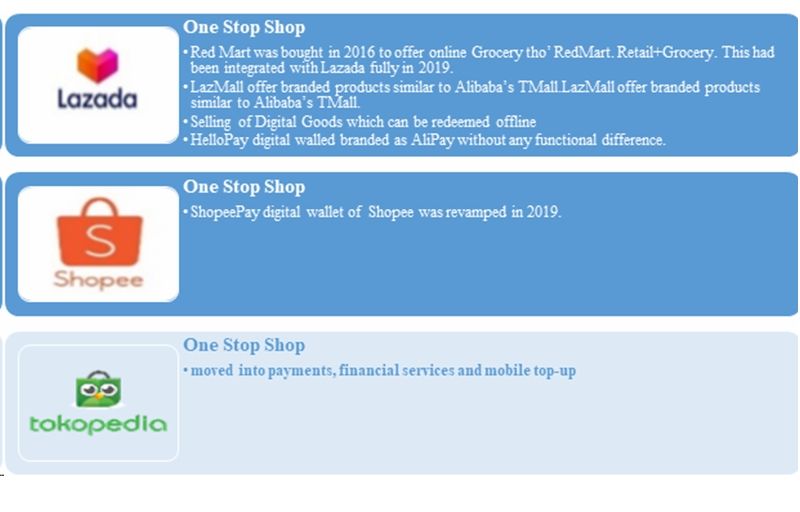

One Stop Shop

Strategies to win the battle

Though there are issues in competitive status, Lazada had produced encouraging results in Q1 2021 earnings. Lazada had recorded 90% Year-over-Year growth for the quarter while recording 100% growth in Indonesia and Vietnam.

Lazada should work closely with Alibaba’s team and quickly adopt following technology driven strategies to push the envelope forward. Lazada is in a privilege position as a subsidiary of Alibaba due to parent’s deep pockets (recording net income of US$ 26 Billion for financial year ending in March 2021) for expansion, the possibility of integrating with Alibaba platforms for service improvement and cross pollination. SEA the parent of Shopee is a giant in Gaming, eCommerce and Fintech. But in overall it had recorded losses cumulatively in the 2Qr 2021. As China is ahead of the curve, the best way to grow is adapting well tested Chinese practices without reinventing the wheel.

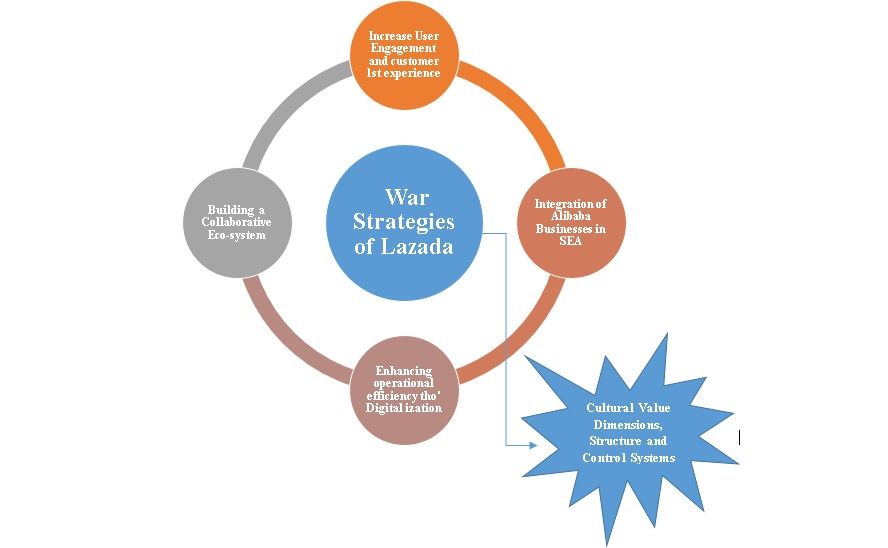

Model for War Strategies of Lazada (illustration / concept by Mothilal De Silva)

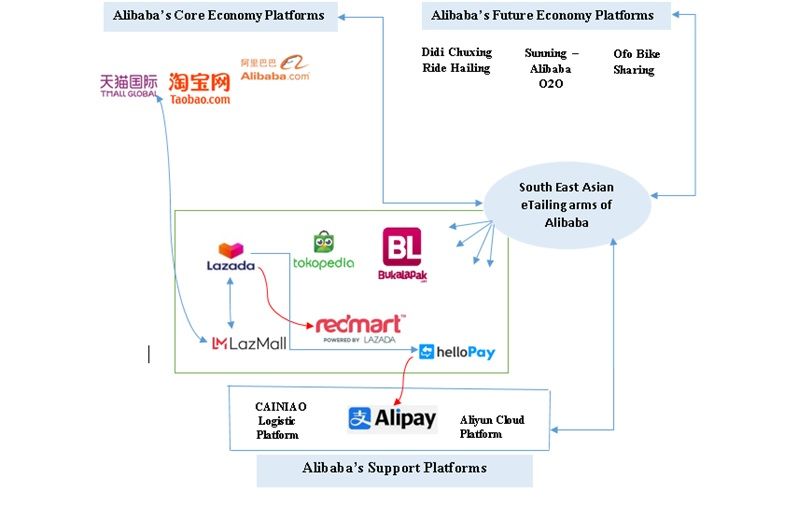

Integration of Alibaba’s businesses in SEA

As explained before, Alibaba progressively acquired Lazada, Tokopedia Indonesia and Redmart Singapore with a probable long term objective of encouraging the use of Alipay, Aliyun Cloud, Alimama and CANIAO logistic Platforms instead of pushing their Core Products in SEA’s B2C and C2C markets. Recent Tokopedia and Go-Jek merger give a possibility of working with Go-Jek’s last mile delivery and integrate with Go-Pay and its affiliate bank Jago. Lazada’s possible partnership with Go-Jek do not violate anti-trust regulations though a Tokopedia and Lazada merger may face objections. Go-jek had also invested in OVO. Hence Tokopedia, Go-Jek, Go-Pay, OVO and Lazada can build a strong collaborative ecosystem in the biggest market Indonesia for logistic and payment.

According to a study done by Bain & Company in 2021, SEA market is more receptive for shopping Grocery items online during the pandemic and this trend will be maintained even in new normal situation. Therefore integration of Redmart operations in Singapore is quite significant. In the post COVID era, Lazada’s grocery arm in Singapore recorded a growth of more than 1000%. Redmart support many establish grocers in Singapore by building an Open Marketplace. Bukalapak in Indonesia which is an investee of Ant Financial, an affiliate of Alibaba, has built a network of small kiosks and traditional grocers which represent large portion of grocery market in Indonesia. Bukalapak can also work closely with Lazada in building mutually beneficial ecosystem by sharing its platforms such as AliPay, O2O and Cainiao.

But this is a journey and full integration with Alibaba and platforms of associated companies in SEA can make Lazada an Asset Light operation. Lazada owns large number of warehouses and nearly 40 fulfilment centres across SEA. Though it has a highly reliable logistic system that had won the confidence of merchants, heavy investment on Warehousing and high OPEX for logistic, carrying cost or depreciation of Inventory may not be sustainable in the long run. Lazada can study how Alibaba’s Taobao fulfilment rely on key set of partners for warehousing, logistic and last mile operations networked by using CAINIO logistic platform. Previous owners of Lazada, Rocket Internet is a Start-Up factory churning out mobile applications expeditiously by cloning established products like Amazon and launch them in virgin markets without any adaptations with the clear objective of gaining user numbers, market share and high valuation faster. They have strong backing of Venture Capitalist and conducted serial funding exercises for market expansion. Lazada’s EBITDA was negative and it was standing at staggering (-29%) in 2016. According to the recently released Annual Report, Alibaba is committed for integration LAZADA with Alibaba ecosystem and appointing CEOs and CTOs from Alibaba is a sign of spreading its influence to make LAZADA profitable and sustainable.

Lazada is in the right path of integrating with Alibaba’s logistic platform CAINIO, which is partly owned by key logistic partners of Alibaba. Nearly 200,000 Chinese high end merchants opened their shops in Lazada’s LazMall platform while enhancing product offerings by following the footsteps of Taobao and TMall of Alibaba. Infrastructure owned by CAINIAO such as dedicated transit warehouses, consolidation stations and drop off points in key exports hubs such as Yiwu, Shenzhen, and Quanzhou in China and in Malaysia are effectively used by Lazada for express delivery / cross border selling, thanks to the integration effort. eWTP (electronic world trade platform) set up at KLIA airport as a joint venture between CAINIAO and Malaysia Airport’s Aeropolis will help facilitating 24 hr LazMall delivery from China within SEA. As Lazada’s delivery is more reliable and faster than Shopee, they should take steps to integrate the delivery arms of affiliated companies of Alibaba and strengthen more. Integration within Alibaba ecosystem is more cost effective than vertical integration.

Enhancing operational efficiency tho' Digitalisation and re-architecting

“It is natural to assume Alibaba will look to replicate its model of combining an integrated e-commerce platform with a trusted payment solution and end to end logistic network that has proved so successful in China”

(PWC Experience Centre, 2016, 10)

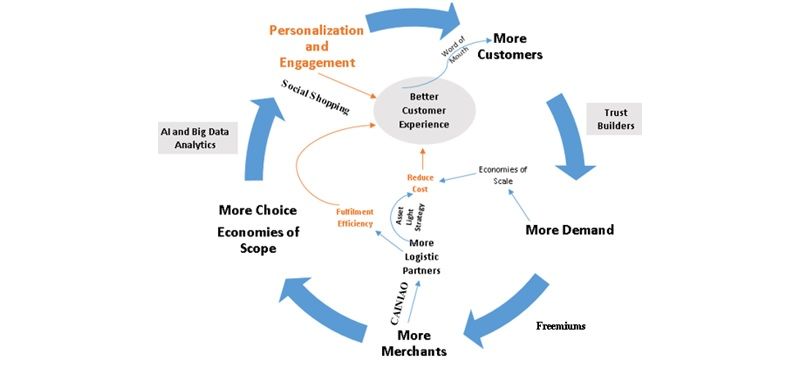

According to Alibaba’s Annual Report (March 2018), Alibaba had integrated Lazada’s operations into the Alibaba’s ecosystem by re-architecting its core technology infrastructure. But it is too early to measure the Synergistic effect in terms of profitability and improvement in operational efficiency. According to the reports of 1st Quarter 2018, Alibaba Group’s EBITDA% had decreased from 59% to 43% mainly due to the higher cost incurred due to Asset Heavy strategy of Lazada. Lazada is a clone of old Amazon following the same strategies (maintain inventory, warehousing as Amazon, commission on transaction) of Asset Heavy as against Alibaba’s Asset Light, Platform Model based on Advertising Revenue. As this model is not sustainable, Lazada should re-architect itself as a fully integrated platform model by taking Alibaba in China as an example. Re-architecting to integrate different platform as given below increase efficiency while reducing cost. These integrated platforms can help providing a network effect / virtuous cycle and data intelligence. Application Programming Interface (APIs) are the integration tool. Here is a description for some of the functions / platforms that need an orchestrated play.

- Logistic / Cross Border selling /Fulfilment – Similar to CAINIAO for autonomous management of logistics, 1st mile, last mile, warehousing, order fulfilment, return management – Moving from linear supply chain to networked supply chain

- Social Shopping / Shoppertainment – Social media integration and facilitating live promotions that are conducted by Key Opinion Leaders or as in china by web celebrities. Similar to Taobao’s experience, it is necessary integrate with Social Media (within China Weibo and WeChat), Alipay for payment, logistic platform CAINIAO to integrate supply chain. Obviously necessary adaptations need to be done to suit SEA market. .

- O2O, Online to Offline, One Stop Shop –

- Merchant Centricity / Customer Centricity – Good to learn from parent Alibaba. Example- chat line WangWang, Optical recognition of products of Taobao done through data intelligence

- Payment / Escrow Service – Though digital pay is the most popular form of payment mode in SEA, digital wallet market is in a highly fragmented status. Lack of having a unified ecosystem for e-Commerce and digital wallet is a real issue for the growth of e-Commerce in SEA in contrast to the coupling of eBay & Paypal and Alibaba & Alipay. Lazada may need to find a way of replicating or replaying Alipay legacy in SEA. Alibaba offer Escrow to reduce trust barriers. Shopee pioneered escrow in SEA to give more security as offered by Alibaba. It is advantageous for Lazada to promote an Escrow service integrated with payment and logistic, as a trust building measure

Building a Collaborative Eco-system

Lazada can learn from parent company Alibaba group in building a platform driven collaborative ecosystem. For Singles Day 11/11, diverse set of stakeholders work in unison to reduce number of fulfilment days for 100 million packages from 14 days in 2012 to just 2.5 days in 2017. Undoubtedly this is achieved through network coordination through different platforms such as logistic platform CAINIO, Artificial Intelligence and data technologies. CAINIO streamlined entire fulfilment process. These platforms not only coordinate sellers, buyers, 3rd party suppliers, producers and logistic providers, but also web celebrities, services providers that provision web sites. More network coordination or more collaboration produce more data resulting better data intelligence.

Lazada could easily adapt Alibaba platforms such as CAINIO, not only to improve fulfilment efficiency but also to reduce cost through outsourcing.

In China, since most of the people maintain a bank account, a mobile wallet can easily be created by linking Alipay or WePay (a WeChat service offered by Tencent and JD.com). But in highly populated SEA countries, operators need to run a local top-up network to load money into a mobile wallet due to 3.1 and 3.2 of PEST Table depicted before.

Virtuous Cycle, Multi Sided Network Effect of a core e-Tailing platform of Taobao integrated with Payment, Logistic and Analytic Platforms (developed by the author)

Increase User Engagement and Customer 1st Experience

Multifold user engagement models and multiple ways of enhancing customer 1st experience are listed below briefly.

- Livestream and gamification

Livestream and Gamification can effectively be used for user engagement – Live-Stream craze popularized by e-commerce platforms like Pinduoduo (Demand Aggregation / Group Buying platform) and Taobao in China had set in motion by Lazada and Shopee in SEA in the midst of COVID. The shop fronts in both platforms had reoriented their businesses to have a direct interaction with customers to grab “Share of Time” as a way of winning “Share of Wallet”. In the current context, “Customer 1st experience” is not a mere marketing slogan or a live promotion. Live streaming experience could become more interactive and technology driven in future by integrating retailer’s supply chain to respond dynamically. Lazada can use Live-streaming, Shoppertainment (shopping as entertainment) and Social Shopping or Social Marketing in combination to personalize products, a shift from mass marketing to mass customization and can even move towards on-demand manufacturing using machine learning and big data technologies.

Pinduduo experience in Social Shopping in China

Lazada can learn a lot from Alibaba’s experience of investing in web-celeb incubators like Ruhan. Ruhan had successfully incubated hundreds of Key Opinion Leaders or KOLs and mentored them in Social Media Marketing, Content Production, Analytics and dynamic demand management through a network of manufacturers. One of Ruhan’s mentored web celebrity, Big E had secured US$15 Million in one of the Singles Day promotion. Probably Lazada’s academy can be extended to cover these areas in more detail, targeting merchants.

Chinese web celebrities / KOLs hosting livestream sessions using technologies such as VR for upmarket products like Lanvin Photo Credit: Lanvin, Internet Celebrity Zhang Dayi

Lazada can also build an ecosystem around gaming by collaborating with mobile gaming / e-Sport similar to JD.com’s intended partnership with Tencent for gaming in China. JD.com is planning to become an ecosystem partner by forging alliances with gaming companies with the purpose of associating with the young, building lifetime value for your future customer. But some gaming apps might have to face some regulatory scrutiny or restrictions due to the increasing social concern for gaming addiction.

By following the experience of Social Shopping and Gamification in China who is the leader in this areas of group or social interactive buying, Lazada can reduce the offline advertisement and promotion cost drastically as community focus Social Shopping is more effective.

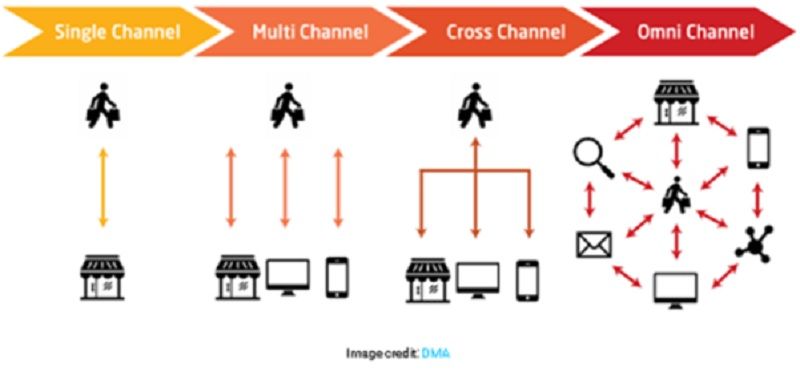

2. O2O, Omni Channel experience

Integrating online and offline retail elements such as products, services, logistics, marketing, analytics etc. in a seamless fashion across a single value chain is the new frontier in e Commerce. According to recently concluded study conducted by Boston Group Consulting in China, more customers demand Omni-Channel shopping experience for luxury goods purchases. It is the experience of buying anything from anywhere at any time. In O2O, experience is coherent, immersed in an experience where the information flow is conducted in a channel independent manner.

Omni-channel Engagement with customers

Omni-channel Engagement with customers

Albaba had entered into partnerships with offline retail giants Bailian Group, Sunning Commerce Group, Intime Retail Group and Sanjiang Shopping Club while pursuing its own strategy of having Hema stores (盒马鲜生) where people shop in physical/tangible world, check details offline/online, study customer reviews online and order online. Lazada partnered with small retailers in Singapore to provide seamless Offline – Online experience by scanning product QR Codes in shops. This can be extended further by taking an example from China where the parent Alibaba is a trend setter.

3. Localization – The growth of home grown brands in Indonesia (Tokopedia and Bukalapak) and in Vietnam (Tiki, Sendo) demonstrate the significance of “Localization”. Lazada need to find a way of localizing “Shoppertainment” to suit each country, taking local preferences into consideration rather than having a “machine gun” or “one fits all” approach. Lazada may also need to have a localized payment strategy. Example – partner with OVO in Indonesia, Grab Pay in Malaysia /Singapore, True Money in Thailand / Vietnam and GCash Wallet in Philippines as paired payment modes with Lazada. A payment integrator may be required by Lazada to have the flexibilty to work with multiple payment platforms, gateways and localise the checkout experience.

4. Taking Trust Building measures – Chinese customers heavily use Social Media and Key Opinion Leaders’ (KOLs’) live Shoppertainment as influencers or guides of their purchasing decisions and trust builders.

Use Block Chain Technology to reduce counterfeit and package losses, authenticate vendors, provide a digital identity, facilitate cross border payment and to provide more transparency. These measures will develop trust.

5. Mobile First – Contemporary strategy of Mobile First, sidestepping desktops, helped Shopee to outstrip Lazada in SEA market.

Conclusion

Alibaba’s sliding share prices do not reflect the business performance of Alibaba’s subsidiary companies in China and SEA. Alibaba as a business, performing well in terms of GMV, Revenue growth, Net Profit, Cash Flow and Lazada is also in a growth trajectory. Therefore Lazada should continue its key strategies such as integration with group businesses, digitalizing to enhance operational efficiency, building a collaborative ecosystem and increasing user engagement by keeping customer 1st experience.

Close cooperation with Alibaba, China and emulating some of its strategies are utmost important for Lazada. But both Lazada and Alibaba should be highly concerned and sensitive to the cultural dimensions. It is also important to formulate appropriate structures and control systems for facilitating interconnectedness between Alibaba / Lazada and for strategy implementation. Revision and Reflection of these areas may be required rather than Resentment.

Share This

Details

Mothilal is a Co Founder of Internet Plus Asia, a co-creation platform for tech start-ups in Asia. Prior to this he was a Chief Executive Officer, Chief Strategy Officer, Chief Corporate Officer and Chief Operating Officer of number of Telecommunications and IT companies in Asia and Pacific regions for over 20 years. He is a turnaround specialist and a strategist. As CEO and C level executives, he was responsiblefor transformation and turning around many telecos. He was also instrumental in winning many international awards for these companies such as GSM awards in 3 consecutive years, International Asia Pacific Quality Award, Asia CSR award. He has obtained the Doctor of Business Administration from PPA Business School, Paris, receiving a Distinction for his DBA research, "Corporate Venture Capital as an engagement model to Co-create 5G ready services in Telco - Startup collaboration"